Introduction to diversified investment options

Diversifying your investments means spreading your money across various types of assets. Think of it as not putting all your eggs in one basket. If one investment dips, others might rise, balancing the impact. Diversified investment options include stocks, bonds, real estate, and more. Each carries its own set of risks and potential rewards. Stocks could offer high returns but come with the risk of market fluctuations. Bonds are generally safer but offer lower returns. Real estate can provide steady income through rent, but it requires more initial capital and is impacted by property market changes. By mixing these investments, you create a safety net for your wealth. This strategy helps protect against significant losses and can lead to more stable and consistent growth over time.

Understanding the basics of investment diversification

Think of diversification like spreading your eggs across different baskets instead of putting them all in one. This approach reduces your risk of losing money if one investment doesn’t perform well. Essentially, it’s about not putting all your money into one type of investment. Here’s how it works: you mix a variety of investments like stocks, bonds, and real estate. This mix helps balance your risk because while some investments may lose value, others can gain, keeping your overall wealth growing over time. It’s a fundamental strategy for building wealth because it tackles the unpredictable nature of investments. So, remember, mixing up where you invest can protect and grow your money, this is especially important during high interest rate environments and periods of high inflation, providing inflation resistant assets.

The benefits of having a diversified investment portfolio

Spreading your investments across various types of assets—stocks, bonds, real estate, and more—is like not putting all your eggs in one basket. It’s smart. Diversification can safeguard your money from the ups and downs of the market. If one investment dips, another might rise, balancing the fall. It’s all about reducing risks. Think of it as a safety net. If one sector crashes, you won’t lose everything. Plus, a diversified portfolio can tap into the growth of different market sectors. Some areas might grow faster than others. By having a bit in each, you’re more likely to catch that growth. It’s also a way to reach your financial goals without betting everything on one racehorse. Different investments perform well under different conditions. By diversifying, you ensure that you always have some investments in optimal conditions, maximizing your chances of building wealth steadily over time. Diversification offers great avenues for wealth protection and wealth preservation. At FalconCo we provide many opportunities to assist with this. Reach out today https://call.falconco.ae/book

How diversified investment options mitigate risks

Diversifying your investment portfolio is like not putting all your eggs in one basket. When you spread your investments across different types of assets, you’re protecting yourself from the risk of losing everything if one investment goes sour. It’s about balancing your investment to withstand the ups and downs of the market. For instance, when the stock market is down, bonds might be up, and vice versa. This way, you’re less likely to face big losses. With a diversified portfolio, you’re aiming for a steadier growth path, avoiding big dips that can happen if you’re too focused on one type of investment. It’s a smart strategy to protect your wealth and keep you on track towards your financial goals.

The role of asset allocation in diversification

Diversifying your investments means not putting all your eggs in one basket. Why? Because markets are unpredictable. Asset allocation plays a crucial role in this. Think of asset allocation as your investment’s game plan. It involves dividing your investments among different categories like stocks, bonds, and cash. Here’s the kicker: each asset class has its own set of risks and rewards. By spreading your investments across these categories, you reduce the risk of losing all your money if one market tanks. It’s not about picking winners; it’s about having a balanced mix that can weather different market conditions. Stocks may offer high returns but come with higher risk. Bonds are less volatile but offer lower returns. Cash is the safest but offers the least potential for growth. A smart asset allocation adjusts as you near retirement age, gradually shifting towards safer investments. No single formula fits everyone; it depends on your age, risk tolerance, and financial goals. Remember, diversification through asset allocation isn’t about making a quick buck; it’s about setting yourself up for long-term financial success. Of course passive income is important also, which is why we offer our HNWI clients an fixed income return that suits their needs. Learn more at www.falconco.ae/products

Diversified investment options across different sectors and geographies

When it comes to building wealth, sticking all your money in one place is like putting all your eggs in one basket. It’s risky. Diversified investment means spreading your investments across various sectors and geographies. This approach helps manage risk because when one sector or region faces downturns, another might be thriving, balancing out potential losses.

Diversifying across sectors means investing in different industries—tech, healthcare, energy, for example. Each sector reacts differently to economic changes. Tech might boom while energy slumps, and vice versa. Likewise, geographies matter. Markets in the US might struggle, while those in Asia or Europe could be hitting all-time highs. By spreading your investments, you’re not relying on the success of a single sector or region.

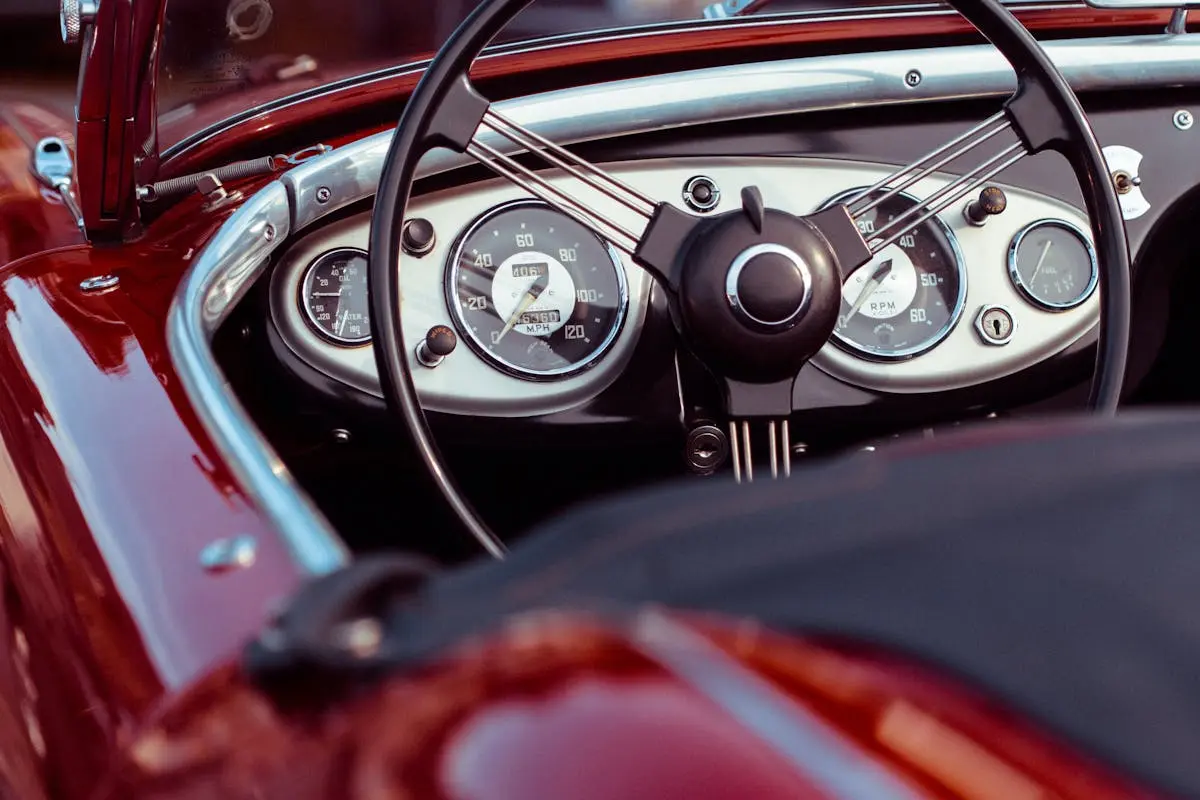

Think of it as not betting on a single horse but rather on many in different races. This strategy won’t guarantee a win every time, but it significantly reduces the chance of a total loss, aiming for a steady growth over time. Remember, wealth building is a marathon, not a sprint. Diversified investment options are essential in pacing yourself towards financial success. Especially if you want to protect your wealth, alternative assets such as our classic car fund or art fund can assist greatly with this. Reach out to book a call at no cost and no commitment at https://call.falconco.ae/book

The impact of market volatility on non-diversified portfolios

When you put all your eggs in one basket, a single market dip can wipe out a big chunk of your investment. That’s the risk with non-diversified portfolios. Market volatility, or the ups and downs in the market, can hit these hard. If your investment is all in one sector or company, and that sector or company takes a nosedive, your entire investment feels the impact. Bet on different sectors, and you spread the risk. When one sector is down, another might be up. This balance can protect you from losing it all when the market gets wild. Remember, diversifying isn’t about avoiding losses altogether but about managing risk in a way that keeps your wealth-building journey on track, despite the storms the market might throw your way.

Diversifying your investment: Stocks, bonds, real estate, and beyond

Putting all your money in one place is like betting it all on one horse. It’s risky. Diversifying your investment means spreading your money across different types of investments like stocks, bonds, and real estate. Why? Well, it’s about not putting all your eggs in one basket. If one investment goes down, others might go up or stay stable, balancing things out. Stocks can offer high returns but are volatile. Bonds are less risky but offer lower returns. Real estate adds another layer of diversity, often moving independently of stock markets. Beyond these, you can explore commodities or invest in mutual funds that mix it all up for you. Diversification doesn’t eliminate risk but can reduce it and help smooth out your investment returns over time. Aim to build a diverse portfolio that fits your risk tolerance and financial goals. Our CEO and Founder provides expert analysis for our HNWI clients, giving them wealth protection insights. Contact us today at https://call.falconco.ae/book and speak with our CEO Issac Qureshi.

Strategies for building a diversified investment portfolio

To build a diversified investment portfolio, think of it as creating a balanced meal. You need different food groups to ensure you’re getting all the essential nutrients. Similarly, a diversified portfolio combines various investments to minimize risks and maximize returns. Here are some straightforward strategies to achieve this:

First, spread your investments across different asset classes. This could mean putting money into stocks, bonds, real estate, and even commodities. Each asset class behaves differently over time. If stocks are down, real estate might be up, balancing your overall risk.

Next, consider geographical diversification. Don’t put all your money in one country’s market. Investing in international markets can protect you from country-specific economic downturns.

Also, rebalance your portfolio regularly. This means adjusting your investments to maintain your desired level of risk. If one part of your portfolio does too well, it might become a larger slice of your investment pie than you initially wanted, increasing your risk.

Lastly, understand your time horizon and risk tolerance. If you’re younger, you might afford to take more risk for potentially higher returns since you have time to recover from any downturns. As you get older or closer to needing the money, you might shift to more conservative investments.

By following these strategies, you can create a diversified portfolio that suits your financial goals and comfort with risk. Remember, the goal isn’t to eliminate risk but to manage it smartly.

Conclusion: The importance of diversification in wealth building

In wrapping up, the key to securing your financial future and building wealth lies firmly in diversification. Spreading your investments across different types of assets — like stocks, bonds, and real estate — acts as a safety net that reduces risk. When one investment underperforms, another might excel, stabilizing your portfolio overall. Diversification is not just a strategy but a fundamental principle for smart investing. It’s crucial for long-term financial health. By diversifying, you’re not putting all your eggs in one basket, but rather, you’re creating multiple streams of potential income and growth opportunities. Remember, the goal is not to eliminate risk but to manage it in a way that aligns with your financial objectives and comfort level. So, take the step, spread your investments, and pave the way to building a robust and resilient financial future.